Page 12 - ICAI UAE TAX UPDATE_APRIL 2024

P. 12

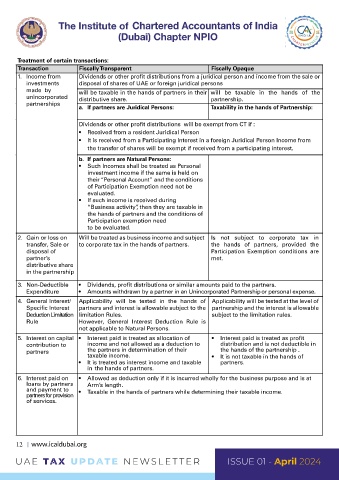

Treatment of certain transactions:

Transaction Fiscally Transparent Fiscally Opaque

1. Income from Dividends or other profit distributions from a juridical person and income from the sale or

investments disposal of shares of UAE or foreign juridical persons

made by will be taxable in the hands of partners in their will be taxable in the hands of the

unincorporated distributive share. partnership.

partnerships

a. If partners are Juridical Persons: Taxability in the hands of Partnership:

Dividends or other profit distributions will be exempt from CT if :

• Received from a resident Juridical Person

• It is received from a Participating Interest in a foreign Juridical Person Income from

the transfer of shares will be exempt if received from a participating interest.

b. If partners are Natural Persons:

• Such Incomes shall be treated as Personal

investment income if the same is held on

their “Personal Account” and the conditions

of Participation Exemption need not be

evaluated.

• If such income is received during

“Business activity”, then they are taxable in

the hands of partners and the conditions of

Participation exemption need

to be evaluated.

2. Gain or loss on Will be treated as business income and subject Is not subject to corporate tax in

transfer, Sale or to corporate tax in the hands of partners. the hands of partners, provided the

disposal of Participation Exemption conditions are

partner’s met.

distributive share

in the partnership

3. Non-Deductible • Dividends, profit distributions or similar amounts paid to the partners.

Expenditure • Amounts withdrawn by a partner in an Unincorporated Partnership or personal expense.

4. General Interest/ Applicability will be tested in the hands of Applicability will be tested at the level of

Specific Interest partners and interest is allowable subject to the partnership and the interest is allowable

Deduction Limitation limitation Rules. subject to the limitation rules.

Rule However, General Interest Deduction Rule is

not applicable to Natural Persons.

5. Interest on capital • Interest paid is treated as allocation of • Interest paid is treated as profit

contribution to income and not allowed as a deduction to distribution and is not deductible in

partners the partners in determination of their the hands of the partnership .

taxable income. • It is not taxable in the hands of

• It is treated as interest income and taxable partners.

in the hands of partners.

6. Interest paid on • Allowed as deduction only if it is incurred wholly for the business purpose and is at

loans by partners Arm’s length.

and payment to • Taxable in the hands of partners while determining their taxable income.

partners for provision

of services.

12 www.icaidubai.org

UA E TAX UP DATE NEWSLET TER ISSUE 01 - April 2024