Page 13 - ICAI UAE TAX UPDATE_APRIL 2024

P. 13

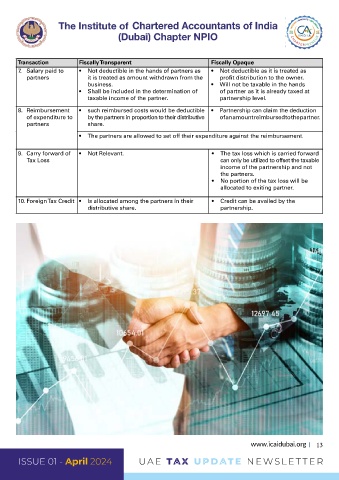

Transaction Fiscally Transparent Fiscally Opaque

7. Salary paid to • Not deductible in the hands of partners as • Not deductible as it is treated as

partners it is treated as amount withdrawn from the profit distribution to the owner.

business. • Will not be taxable in the hands

• Shall be included in the determination of of partner as it is already taxed at

taxable income of the partner. partnership level.

8. Reimbursement • such reimbursed costs would be deductible • Partnership can claim the deduction

of expenditure to by the partners in proportion to their distributive of an amount reimbursed to the partner.

partners share.

• The partners are allowed to set off their expenditure against the reimbursement.

9. Carry forward of • Not Relevant. • The tax loss which is carried forward

Tax Loss can only be utilized to offset the taxable

income of the partnership and not

the partners.

• No portion of the tax loss will be

allocated to exiting partner.

10. Foreign Tax Credit • Is allocated among the partners in their • Credit can be availed by the

distributive share. partnership.

www.icaidubai.org 13

UA E TAX UPD ATE NEWSLET TER ISSUE 01 - April 2024 ISSUE 01 - April 2024 UA E TAX UPD ATE NEWSLET TER