Page 11 - ICAI UAE TAX UPDATE_October 2024

P. 11

projects of a similar nature from a Government Entity to

another Government Entity, including any granted or

transferred right of use, exploitation or utilization as of 1

January 2023.

2. For the purposes of Clause 1 of this Article, Government

buildings, real estate assets and other projects of similar

nature shall mean the following: a. Government Entities’

premises.

b. Government capital projects.

c. Government infrastructural projects.

d. Real estate assets utilised and used by Government

Entities.

e. Real estate assets allocated and utilised to serve a public

utility and for public use.

f. Developed Government land.

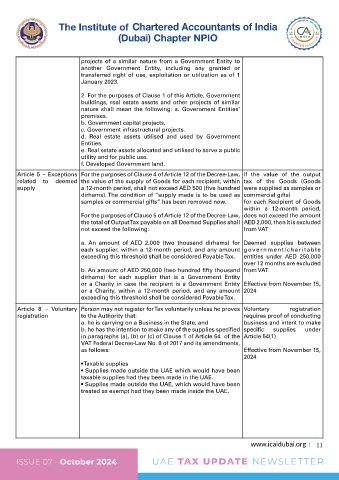

Article 5 – Exceptions For the purposes of Clause 4 of Article 12 of the Decree-Law, If the value of the output

related to deemed the value of the supply of Goods for each recipient, within tax of the Goods (Goods

supply a 12-month period, shall not exceed AED 500 (five hundred were supplied as samples or

dirhams). The condition of “supply made is to be used as commercial gifts)

samples or commercial gifts” has been removed now. for each Recipient of Goods

within a 12-month period,

For the purposes of Clause 5 of Article 12 of the Decree-Law, does not exceed the amount

the total of Output Tax payable on all Deemed Supplies shall AED 2,000, then it is excluded

not exceed the following: from VAT

a. An amount of AED 2,000 (two thousand dirhams) for Deemed supplies between

each supplier, within a 12-month period, and any amount government/charitable

exceeding this threshold shall be considered Payable Tax. entities under AED 250,000

over 12 months are excluded

b. An amount of AED 250,000 (two hundred fifty thousand from VAT.

dirhams) for each supplier that is a Government Entity

or a Charity in case the recipient is a Government Entity Effective from November 15,

or a Charity, within a 12-month period, and any amount 2024

exceeding this threshold shall be considered Payable Tax.

Article 8 – Voluntary Person may not register for Tax voluntarily unless he proves Voluntary registration

registration to the Authority that: requires proof of conducting

a. he is carrying on a Business in the State, and business and intent to make

b. he has the intention to make any of the supplies specified specific supplies under

in paragraphs (a), (b) or (c) of Clause 1 of Article 54 of the Article 54(1)

VAT Federal Decree-Law No. 8 of 2017 and its amendments,

as follows: Effective from November 15,

2024

• Taxable supplies

• Supplies made outside the UAE which would have been

taxable supplies had they been made in the UAE.

• Supplies made outside the UAE, which would have been

treated as exempt had they been made inside the UAE.

www.icaidubai.org 11

UAE TAX UPDATE NEWSLETTER ISSUE 07 - October 2024 ISSUE 07 - October 2024 UAE TAX UPDATE NEWSLETTER