Page 13 - ICAI UAE TAX UPDATE_October 2024

P. 13

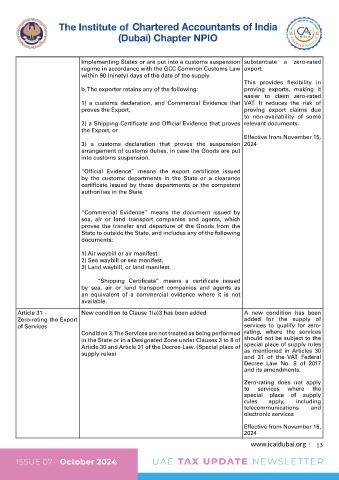

Implementing States or are put into a customs suspension substantiate a zero-rated

regime in accordance with the GCC Common Customs Law export.

within 90 (ninety) days of the date of the supply.

This provides flexibility in

b. The exporter retains any of the following: proving exports, making it

easier to claim zero-rated

1) a customs declaration, and Commercial Evidence that VAT. It reduces the risk of

proves the Export, proving export claims due

to non-availability of some

2) a Shipping Certificate and Official Evidence that proves relevant documents.

the Export, or

Effective from November 15,

3) a customs declaration that proves the suspension 2024

arrangement of customs duties, in case the Goods are put

into customs suspension.

“Official Evidence” means the export certificate issued

by the customs departments in the State or a clearance

certificate issued by these departments or the competent

authorities in the State

“Commercial Evidence” means the document issued by

sea, air or land transport companies and agents, which

proves the transfer and departure of the Goods from the

State to outside the State, and includes any of the following

documents:

1) Air waybill or air manifest.

2) Sea waybill or sea manifest.

3) Land waybill, or land manifest.

“Shipping Certificate” means a certificate issued

by sea, air or land transport companies and agents as

an equivalent of a commercial evidence where it is not

available.

Article 31 – New condition to Clause 1(a)3 has been added A new condition has been

Zero-rating the Export added for the supply of

of Services services to qualify for zero-

Condition 3. The Services are not treated as being performed rating, where the services

in the State or in a Designated Zone under Clauses 3 to 8 of should not be subject to the

Article 30 and Article 31 of the Decree-Law. (Special place of special place of supply rules

as mentioned in Articles 30

supply rules)

and 31 of the VAT Federal

Decree Law No. 8 of 2017

and its amendments.

Zero-rating does not apply

to services where the

special place of supply

rules apply, including

telecommunications and

electronic services

Effective from November 15,

2024

www.icaidubai.org 13

UAE TAX UPDATE NEWSLETTER ISSUE 07 - October 2024 ISSUE 07 - October 2024 UAE TAX UPDATE NEWSLETTER