Page 14 - ICAI UAE TAX UPDATE_October 2024

P. 14

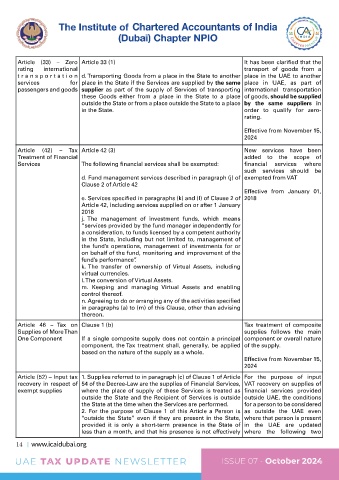

Article (33) – Zero Article 33 (1) It has been clarified that the

rating international transport of goods from a

transpor tation d. Transporting Goods from a place in the State to another place in the UAE to another

services for place in the State if the Services are supplied by the same place in UAE, as part of

passengers and goods supplier as part of the supply of Services of transporting international transportation

these Goods either from a place in the State to a place of goods, should be supplied

outside the State or from a place outside the State to a place by the same suppliers in

in the State. order to qualify for zero-

rating.

Effective from November 15,

2024

Article (42) – Tax Article 42 (3) New services have been

Treatment of Financial added to the scope of

Services The following financial services shall be exempted: financial services where

such services should be

d. Fund management services described in paragraph (j) of exempted from VAT

Clause 2 of Article 42

Effective from January 01,

e. Services specified in paragraphs (k) and (l) of Clause 2 of 2018

Article 42, including services supplied on or after 1 January

2018

j. The management of investment funds, which means

“services provided by the fund manager independently for

a consideration, to funds licensed by a competent authority

in the State, including but not limited to, management of

the fund’s operations, management of investments for or

on behalf of the fund, monitoring and improvement of the

fund’s performance”.

k. The transfer of ownership of Virtual Assets, including

virtual currencies.

l. The conversion of Virtual Assets.

m. Keeping and managing Virtual Assets and enabling

control thereof.

n. Agreeing to do or arranging any of the activities specified

in paragraphs (a) to (m) of this Clause, other than advising

thereon.

Article 46 – Tax on Clause 1 (b) Tax treatment of composite

Supplies of More Than supplies follows the main

One Component If a single composite supply does not contain a principal component or overall nature

component, the Tax treatment shall, generally, be applied of the supply.

based on the nature of the supply as a whole.

Effective from November 15,

2024

Article (52) – Input tax 1. Supplies referred to in paragraph (c) of Clause 1 of Article For the purpose of input

recovery in respect of 54 of the Decree-Law are the supplies of Financial Services, VAT recovery on supplies of

exempt supplies where the place of supply of these Services is treated as financial services provided

outside the State and the Recipient of Services is outside outside UAE, the conditions

the State at the time when the Services are performed. for a person to be considered

2. For the purpose of Clause 1 of this Article a Person is as outside the UAE even

“outside the State” even if they are present in the State, where that person is present

provided it is only a short-term presence in the State of in the UAE are updated

less than a month, and that his presence is not effectively where the following two

14 www.icaidubai.org

UAE TAX UPDATE NEWSLETTER ISSUE 07 - October 2024