Page 10 - ICAI UAE TAX UPDATE_October 2024

P. 10

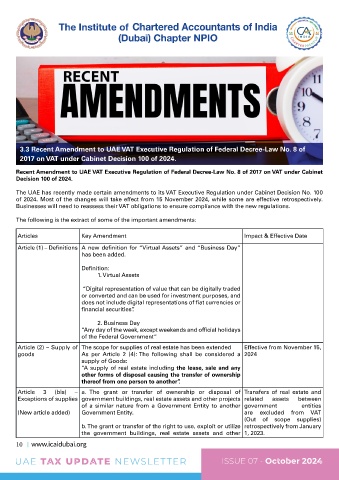

3.3 Recent Amendment to UAE VAT Executive Regulation of Federal Decree-Law No. 8 of

2017 on VAT under Cabinet Decision 100 of 2024.

Recent Amendment to UAE VAT Executive Regulation of Federal Decree-Law No. 8 of 2017 on VAT under Cabinet

Decision 100 of 2024.

The UAE has recently made certain amendments to its VAT Executive Regulation under Cabinet Decision No. 100

of 2024. Most of the changes will take effect from 15 November 2024, while some are effective retrospectively.

Businesses will need to reassess their VAT obligations to ensure compliance with the new regulations.

The following is the extract of some of the important amendments:

Articles Key Amendment Impact & Effective Date

Article (1) – Definitions A new definition for “Virtual Assets” and “Business Day”

has been added.

Definition:

1. Virtual Assets

“Digital representation of value that can be digitally traded

or converted and can be used for investment purposes, and

does not include digital representations of fiat currencies or

financial securities” .

2. Business Day

“Any day of the week, except weekends and official holidays

of the Federal Government“

Article (2) – Supply of The scope for supplies of real estate has been extended Effective from November 15,

goods As per Article 2 (4): The following shall be considered a 2024

supply of Goods:

“A supply of real estate including the lease, sale and any

other forms of disposal causing the transfer of ownership

thereof from one person to another” .

Article 3 (bis) – a. The grant or transfer of ownership or disposal of Transfers of real estate and

Exceptions of supplies government buildings, real estate assets and other projects related assets between

of a similar nature from a Government Entity to another government entities

(New article added) Government Entity. are excluded from VAT

(Out of scope supplies)

b. The grant or transfer of the right to use, exploit or utilize retrospectively from January

the government buildings, real estate assets and other 1, 2023.

10 www.icaidubai.org

UAE TAX UPDATE NEWSLETTER ISSUE 07 - October 2024