Page 15 - ICAI UAE TAX UPDATE_October 2024

P. 15

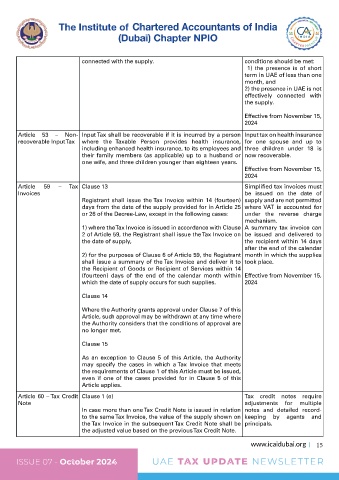

connected with the supply. conditions should be met:

1) the presence is of short

term in UAE of less than one

month, and

2) the presence in UAE is not

effectively connected with

the supply.

Effective from November 15,

2024

Article 53 – Non- Input Tax shall be recoverable if it is incurred by a person Input tax on health insurance

recoverable Input Tax where the Taxable Person provides health insurance, for one spouse and up to

including enhanced health insurance, to its employees and three children under 18 is

their family members (as applicable) up to a husband or now recoverable.

one wife, and three children younger than eighteen years.

Effective from November 15,

2024

Article 59 – Tax Clause 13 Simplified tax invoices must

Invoices be issued on the date of

Registrant shall issue the Tax Invoice within 14 (fourteen) supply and are not permitted

days from the date of the supply provided for in Article 25 where VAT is accounted for

or 26 of the Decree-Law, except in the following cases: under the reverse charge

mechanism.

1) where the Tax Invoice is issued in accordance with Clause A summary tax invoice can

2 of Article 59, the Registrant shall issue the Tax Invoice on be issued and delivered to

the date of supply, the recipient within 14 days

after the end of the calendar

2) for the purposes of Clause 6 of Article 59, the Registrant month in which the supplies

shall issue a summary of the Tax Invoice and deliver it to took place.

the Recipient of Goods or Recipient of Services within 14

(fourteen) days of the end of the calendar month within Effective from November 15,

which the date of supply occurs for such supplies. 2024

Clause 14

Where the Authority grants approval under Clause 7 of this

Article, such approval may be withdrawn at any time where

the Authority considers that the conditions of approval are

no longer met.

Clause 15

As an exception to Clause 5 of this Article, the Authority

may specify the cases in which a Tax Invoice that meets

the requirements of Clause 1 of this Article must be issued,

even if one of the cases provided for in Clause 5 of this

Article applies.

Article 60 – Tax Credit Clause 1 (e) Tax credit notes require

Note adjustments for multiple

In case more than one Tax Credit Note is issued in relation notes and detailed record-

to the same Tax Invoice, the value of the supply shown on keeping by agents and

the Tax Invoice in the subsequent Tax Credit Note shall be principals.

the adjusted value based on the previous Tax Credit Note.

www.icaidubai.org 15

UAE TAX UPDATE NEWSLETTER ISSUE 07 - October 2024 ISSUE 07 - October 2024 UAE TAX UPDATE NEWSLETTER