Page 16 - Focus Group

P. 16

Note – 2: The percentage should be rounded to the nearest whole number [Example: 13.49% to 13%

and 13.50 to 14%]

Note – 3: Please note that in standard method, only expenses [T & E] as per diagram given in Q-1 are to

be considered. Sales or Output Values are not to be used in Standard Method.

Q4: How to apply the Sectoral Method?

• Sectoral Method is a hybrid method and requires additional two steps:

1. Firstly, the residual input tax which pertains to multiple divisions or sectors need to be apportioned

among respective divisions or sectors using either outputs method or Head Count Method as below:

o Headcount method = [Number of staff in the sector] divided by [Total number of staff]

o Outputs method = [Value of supplies in the sector] divided by [Total value of supplies + non-business

activities]

2. Then, the business needs to apply the above-mentioned special method as applicable to respective

sector for bifurcating the allocated residual input tax as per earlier step, into recoverable and non-

recoverable input tax.

Q5: How to do the Annual Wash Adjustment?

• Firstly, apply the standard method on tax year basis and compare the result from it with the residual

tax recovered in respective tax periods. The difference between the two (irrespective of value) shall be

reported in ‘Adjustment’ column of Box - 9 of VAT Return.

• Secondly, apply the special methods mentioned in Q-3 & Q-4 on tax year basis and compare the result

from it with the standard method on tax year basis. If the difference between the two is more than AED

250,000/- then same shall be also be reported in ‘Adjustment’ column of Box - 9 of VAT Return.

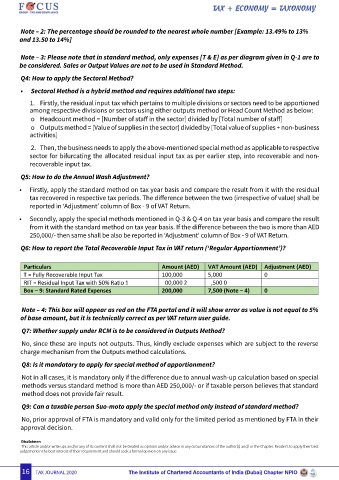

Q6: How to report the Total Recoverable Input Tax in VAT return (‘Regular Apportionment’)?

Amount (AED) VAT Amount (AED) Adjustment (AED)

T = Fully Recoverable Input Tax 100,000 5,000 0

1 00,000 2 ,500 0

Box – 9: Standard Rated Expenses 200,000 7,500 (Note – 4) 0

Note – 4: This box will appear as red on the FTA portal and it will show error as value is not equal to 5%

of base amount, but it is technically correct as per VAT return user guide.

Q7: Whether supply under RCM is to be considered in Outputs Method?

No, since these are inputs not outputs. Thus, kindly exclude expenses which are subject to the reverse

charge mechanism from the Outputs method calculations.

Q8: Is it mandatory to apply for special method of apportionment?

Not in all cases, it is mandatory only if the difference due to annual wash-up calculation based on special

methods versus standard method is more than AED 250,000/- or if taxable person believes that standard

method does not provide fair result.

Q9: Can a taxable person Suo-moto apply the special method only instead of standard method?

No, prior approval of FTA is mandatory and valid only for the limited period as mentioned by FTA in their

approval decision.

Disclaimer:

This article and/or write ups and/or any of its content shall not be treated as opinion and/or advice in any circumstances of the author(s) and/ or the Chapter. Reader’s to apply their best

judgement in the best interest of their requirement and should seek a formal opinion on any issue.

16 TAX JOURNAL 2020 The Institute of Chartered Accountants of India (Dubai) Chapter NPIO