Page 9 - ICAI UAE TAX UPDATE_JUNE 2024

P. 9

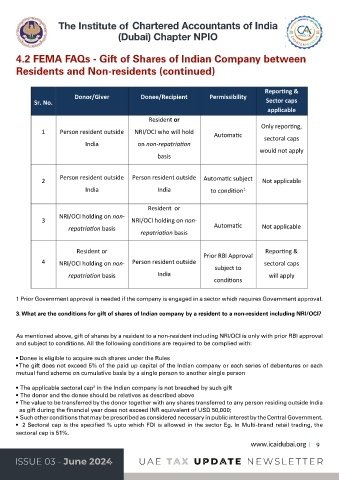

4.2 FEMA FAQs - Gift of Shares of Indian Company between

Residents and Non-residents (continued)

Reporting &

Donor/Giver Donee/Recipient Permissibility

Sr. No. Sector caps

applicable

Resident or

Only reporting,

1 Person resident outside NRI/OCI who will hold Automatic

India on non-repatriation sectoral caps

would not apply

basis

2 Person resident outside Person resident outside Automatic subject Not applicable

India India to condition

1

Resident or

NRI/OCI holding on non-

3 NRI/OCI holding on non-

repatriation basis Automatic Not applicable

repatriation basis

Resident or Prior RBI Approval Reporting &

4 NRI/OCI holding on non- Person resident outside subject to sectoral caps

repatriation basis India conditions will apply

1 Prior Government approval is needed if the company is engaged in a sector which requires Government approval.

3. What are the conditions for gift of shares of Indian company by a resident to a non-resident including NRI/OCI?

As mentioned above, gift of shares by a resident to a non-resident including NRI/OCI is only with prior RBI approval

and subject to conditions. All the following conditions are required to be complied with:

• Donee is eligible to acquire such shares under the Rules

• The gift does not exceed 5% of the paid up capital of the Indian company or each series of debentures or each

mutual fund scheme on cumulative basis by a single person to another single person

• The applicable sectoral cap in the Indian company is not breached by such gift

2

• The donor and the donee should be relatives as described above

• The value to be transferred by the donor together with any shares transferred to any person residing outside India

as gift during the financial year does not exceed INR equivalent of USD 50,000;

• Such other conditions that may be prescribed as considered necessary in public interest by the Central Government.

• 2 Sectoral cap is the specified % upto which FDI is allowed in the sector Eg. In Multi-brand retail trading, the

sectoral cap is 51%.

www.icaidubai.org 9

UA E TAX U PDAT E NEWSLET TER ISSUE 03 - June 2024 ISSUE 03 - June 2024 UA E TAX U PDAT E NEWSLET TER