Page 9 - ICAI UAE TAX UPDATE_JULY 2024

P. 9

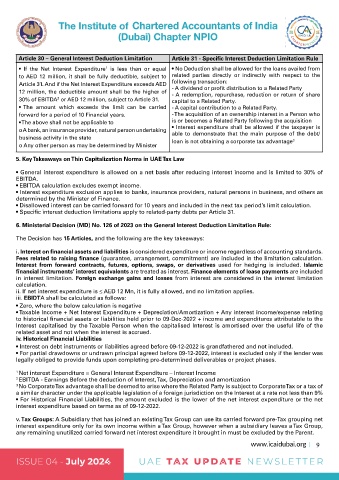

Article 30 – General Interest Deduction Limitation Article 31 - Specific Interest Deduction Limitation Rule

1

• If the Net Interest Expenditure is less than or equal • No Deduction shall be allowed for the loans availed from

to AED 12 million, it shall be fully deductible, subject to related parties directly or indirectly with respect to the

Article 31. And if the Net Interest Expenditure exceeds AED following transaction:

12 million, the deductible amount shall be the higher of - A dividend or profit distribution to a Related Party

- A redemption, repurchase, reduction or return of share

30% of EBITDA or AED 12 million, subject to Article 31. capital to a Related Party.

2

• The amount which exceeds the limit can be carried - A capital contribution to a Related Party.

forward for a period of 10 Financial years. - The acquisition of an ownership interest in a Person who

• The above shall not be applicable to is or becomes a Related Party following the acquisition

o A bank, an insurance provider, natural person undertaking • Interest expenditure shall be allowed if the taxpayer is

able to demonstrate that the main purpose of the debt/

business activity in the state loan is not obtaining a corporate tax advantage

3

o Any other person as may be determined by Minister

5. Key Takeaways on Thin Capitalization Norms in UAE Tax Law

• General interest expenditure is allowed on a net basis after reducing interest income and is limited to 30% of

EBITDA.

• EBITDA calculation excludes exempt income.

• Interest expenditure exclusion applies to banks, insurance providers, natural persons in business, and others as

determined by the Minister of Finance.

• Disallowed interest can be carried forward for 10 years and included in the next tax period’s limit calculation.

• Specific interest deduction limitations apply to related-party debts per Article 31.

6. Ministerial Decision (MD) No. 126 of 2023 on the General Interest Deduction Limitation Rule:

The Decision has 15 Articles, and the following are the key takeaways:

i. Interest on financial assets and liabilities is considered expenditure or income regardless of accounting standards.

Fees related to raising finance (guarantee, arrangement, commitment) are included in the limitation calculation.

Interest from forward contracts, futures, options, swaps, or derivatives used for hedging is included. Islamic

financial instruments’ interest equivalents are treated as interest. Finance elements of lease payments are included

in interest limitation. Foreign exchange gains and losses from interest are considered in the interest limitation

calculation.

ii. If net interest expenditure is ≤ AED 12 Mn, it is fully allowed, and no limitation applies.

iii. EBIDTA shall be calculated as follows:

• Zero, where the below calculation is negative

• Taxable Income + Net Interest Expenditure + Depreciation/Amortization + Any interest income/expense relating

to historical financial assets or liabilities held prior to 09-Dec-2022 + income and expenditures attributable to the

Interest capitalised by the Taxable Person when the capitalised Interest is amortised over the useful life of the

related asset and not when the interest is accrued.

iv. Historical Financial Liabilities

• Interest on debt instruments or liabilities agreed before 09-12-2022 is grandfathered and not included.

• For partial drawdowns or undrawn principal agreed before 09-12-2022, interest is excluded only if the lender was

legally obliged to provide funds upon completing pre-determined deliverables or project phases.

1 Net interest Expenditure = General Interest Expenditure – Interest Income

2 EBITDA - Earnings Before the deduction of Interest, Tax, Depreciation and amortization

3 No Corporate Tax advantage shall be deemed to arise where the Related Party is subject to Corporate Tax or a tax of

a similar character under the applicable legislation of a foreign jurisdiction on the Interest at a rate not less than 9%

• For Historical Financial Liabilities, the amount excluded is the lower of the net interest expenditure or the net

interest expenditure based on terms as of 09-12-2022.

v. Tax Groups: A Subsidiary that has joined an existing Tax Group can use its carried forward pre-Tax grouping net

interest expenditure only for its own income within a Tax Group, however when a subsidiary leaves a Tax Group,

any remaining unutilized carried forward net interest expenditure it brought in must be excluded by the Parent.

www.icaidubai.org 9

UA E TAX UPD ATE NEWSLET TER ISSUE 04 - July 2024 ISSUE 04 - July 2024 UA E TAX UPD ATE NEWSLET TER