Page 6 - ICAI UAE TAX UPDATE_JULY 2024

P. 6

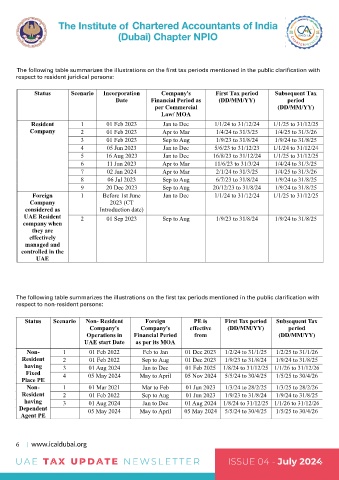

The following table summarizes the illustrations on the first tax periods mentioned in the public clarification with

respect to resident juridical persons:

Status Scenario Incorporation Company's First Tax period Subsequent Tax

Date

period

(DD/MM/YY)

Company's

Status Scenario Incorporation Financial Period as First Tax period Subsequent Tax

per Commercial

period

Date Financial Period as (DD/MM/YY) (DD/MM/YY)

Law/ MOA

per Commercial (DD/MM/YY)

Jan to Dec

Resident 1 01 Feb 2023 Law/ MOA 1/1/24 to 31/12/24 1/1/25 to 31/12/25

Company 2 1 01 Feb 2023 Apr to Mar 1/1/24 to 31/12/24 1/1/25 to 31/12/25

01 Feb 2023

Jan to Dec

1/4/24 to 31/3/25

Resident

1/4/25 to 31/3/26

Company 3 2 01 Feb 2023 Apr to Mar 1/4/24 to 31/3/25 1/4/25 to 31/3/26

1/9/23 to 31/8/24

1/9/24 to 31/8/25

Sep to Aug

01 Feb 2023

Jan to Dec

4 3 01 Feb 2023 Sep to Aug 5/6/23 to 31/12/23 1/1/24 to 31/12/24

1/9/23 to 31/8/24

1/9/24 to 31/8/25

05 Jun 2023

5/6/23 to 31/12/23

05 Jun 2023

1/1/25 to 31/12/25

Jan to Dec

5 4 16 Aug 2023 Jan to Dec 16/8/23 to 31/12/24 1/1/24 to 31/12/24

11/6/23 to 31/3/24

11 Jun 2023

1/4/24 to 31/3/25

6 5 16 Aug 2023 Apr to Mar 16/8/23 to 31/12/24 1/1/25 to 31/12/25

Jan to Dec

7 6 11 Jun 2023 Apr to Mar 11/6/23 to 31/3/24 1/4/24 to 31/3/25

Apr to Mar

1/4/25 to 31/3/26

2/1/24 to 31/3/25

02 Jan 2024

8 7 02 Jan 2024 Apr to Mar 2/1/24 to 31/3/25 1/4/25 to 31/3/26

6/7/23 to 31/8/24

Sep to Aug

06 Jul 2023

1/9/24 to 31/8/25

20 Dec 2023

1/9/24 to 31/8/25

Sep to Aug

9 8 06 Jul 2023 Sep to Aug 20/12/23 to 31/8/24 1/9/24 to 31/8/25

6/7/23 to 31/8/24

1/1/24 to 31/12/24

20 Dec 2023

1/9/24 to 31/8/25

Jan to Dec

Foreign 1 9 Before 1st June Sep to Aug 20/12/23 to 31/8/24 1/1/25 to 31/12/25

Company 1 Before 1st June Jan to Dec 1/1/24 to 31/12/24 1/1/25 to 31/12/25

2023 (CT

Foreign

considered as Introduction date)

2023 (CT

Company

UAE Resident 2 Introduction date) Sep to Aug 1/9/23 to 31/8/24 1/9/24 to 31/8/25

considered as

01 Sep 2023

company when 2 01 Sep 2023 Sep to Aug 1/9/23 to 31/8/24 1/9/24 to 31/8/25

UAE Resident

they are

company when

effectively

they are

managed and

effectively

controlled in the

managed and

UAE

controlled in the

UAE

The following table summarizes the illustrations on the first tax periods mentioned in the public clarification with

respect to non-resident persons:

Status Scenario Non- Resident Foreign PE is First Tax period Subsequent Tax

(DD/MM/YY)

period

Company's

Foreign

PE is

Status Scenario Non- Resident Company's effective First Tax period Subsequent Tax

from

Operations in Financial Period effective (DD/MM/YY) (DD/MM/YY)

Company's

Company's

period

UAE start Date Financial Period from (DD/MM/YY)

as per its MOA

Operations in

Non- 1 UAE start Date as per its MOA 01 Dec 2023 1/2/24 to 31/1/25 1/2/25 to 31/1/26

Feb to Jan

01 Feb 2022

Resident 2 1 01 Feb 2022 Sep to Aug 01 Dec 2023 1/2/24 to 31/1/25 1/2/25 to 31/1/26

01 Dec 2023

Non-

01 Feb 2022

1/9/24 to 31/8/25

1/9/23 to 31/8/24

Feb to Jan

having

Resident 3 2 01 Feb 2022 Sep to Aug 01 Dec 2023 1/9/23 to 31/8/24 1/9/24 to 31/8/25

Jan to Dec

01 Feb 2025 1/8/24 to 31/12/25 1/1/26 to 31/12/26

01 Aug 2024

Fixed

having 4 3 01 Aug 2024 May to April 05 Nov 2024 1/8/24 to 31/12/25 1/1/26 to 31/12/26

5/5/24 to 30/4/25

01 Feb 2025

05 May 2024

Jan to Dec

1/5/25 to 30/4/26

Place PE 4 05 May 2024 May to April 05 Nov 2024 5/5/24 to 30/4/25 1/5/25 to 30/4/26

Fixed

Non-

Place PE 1 01 Mar 2021 Mar to Feb 01 Jun 2023 1/3/24 to 28/2/25 1/3/25 to 28/2/26

Resident 2 1 01 Mar 2021 Mar to Feb 01 Jun 2023 1/3/24 to 28/2/25 1/3/25 to 28/2/26

Non-

1/9/24 to 31/8/25

01 Feb 2022

Sep to Aug

01 Jun 2023

1/9/23 to 31/8/24

having

Resident 3 2 01 Feb 2022 Sep to Aug 01 Jun 2023 1/9/23 to 31/8/24 1/9/24 to 31/8/25

01 Aug 2024

Jan to Dec

01 Aug 2024 1/8/24 to 31/12/25 1/1/26 to 31/12/26

Dependent 3 01 Aug 2024 May to April 01 Aug 2024 5/5/24 to 30/4/25 1/5/25 to 30/4/26

having

05 May 2024 1/8/24 to 31/12/25 1/1/26 to 31/12/26

05 May 2024

Jan to Dec

Agent PE

Dependent 05 May 2024 May to April 05 May 2024 5/5/24 to 30/4/25 1/5/25 to 30/4/26

Agent PE

6 www.icaidubai.org

UA E TAX UPD ATE NEWSLET TER ISSUE 04 - July 2024