Page 24 - Focus Group

P. 24

Laws” (reference to Article 10 Part 4 of the Federal Decree Law No. 7 of 2017 read with the User Guide

published by FTA on July 2018) in layman words.

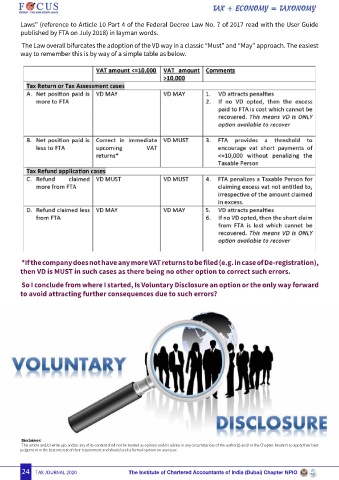

The Law overall bifurcates the adoption of the VD way in a classic “Must” and “May” approach. The easiest

way to remember this is by way of a simple table as below.

*If the company does not have any more VAT returns to be filed (e.g. in case of De-registration),

then VD is MUST in such cases as there being no other option to correct such errors.

So I conclude from where I started, Is Voluntary Disclosure an option or the only way forward

to avoid attracting further consequences due to such errors?

Disclaimer:

This article and/or write ups and/or any of its content shall not be treated as opinion and/or advice in any circumstances of the author(s) and/ or the Chapter. Reader’s to apply their best

judgement in the best interest of their requirement and should seek a formal opinion on any issue.

24 TAX JOURNAL 2020 The Institute of Chartered Accountants of India (Dubai) Chapter NPIO