Page 16 - ICAI UAE TAX UPDATE_JULY 2024

P. 16

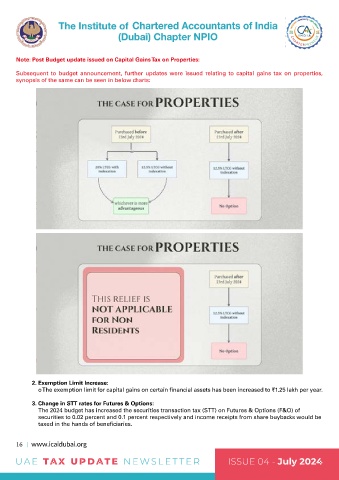

Note: Post Budget update issued on Capital Gains Tax on Properties:

Subsequent to budget announcement, further updates were issued relating to capital gains tax on properties,

synopsis of the same can be seen in below charts:

2. Exemption Limit Increase:

o The exemption limit for capital gains on certain financial assets has been increased to ₹1.25 lakh per year.

3. Change in STT rates for Futures & Options:

The 2024 budget has increased the securities transaction tax (STT) on Futures & Options (F&O) of

securities to 0.02 percent and 0.1 percent respectively and income receipts from share buybacks would be

taxed in the hands of beneficiaries.

16 www.icaidubai.org

UA E TAX UPD ATE NEWSLET TER ISSUE 04 - July 2024